Being injured is bad enough on its own, but what’s even worse is when it’s someone else’s fault and you end up with huge medical bills and a measly settlement offer that won’t cover them.

A trip to the hospital can cost thousands of dollars. Your emergency room visit alone may run up a bill as high as $11,000—and that’s without accounting for other expenses like ambulance rides or surgery.

It’s frustrating when an insurance company offers you a settlement for your medical bills that don’t come close to paying what your treatments cost. Luckily, you don’t have to accept their offer, and you might even get them to suggest something better. Read on to learn more about your options for settling with an insurance company.

How to Reject a Settlement Offer?

You can reject a settlement offer by simply turning it down. If you’re represented by an attorney, you can advise them to decline for you.

If you’re not represented by an attorney, then there’s nothing stopping you from rejecting the offer yourself. But if this is your first time dealing with insurance companies, it’s a good idea to consult with a reliable lawyer who can help you decide whether the terms of the deal are fair.

Keep in mind that once you reject a settlement offer, it’s final. You can’t change your mind later on and decide to accept it. If the insurance company wants to make a new offer, they’ll have to do so from scratch.

How Long Do You Have Before a Settlement Offer Expires?

The insurance company will give you a deadline by which they expect you to accept or reject their settlement offer. This date is usually somewhere between 30 and 60 days after their investigation. If you haven’t decided within this time frame, the company will revoke the offer.

It’s not unusual for companies to leave off deadlines and hope for a timely response. In this instance, the company can withdraw the offer at its will.

Is There a Benefit to Rejecting a Settlement Offer?

Rejecting a settlement offer from an insurance company has some benefits. While there are no guarantees that you will get better terms than the ones they have presented you with, it’s possible that you can negotiate for more money. If the insurance company thinks your case is strong, they may give in and offer higher pay.

Can You Get a Second Settlement Offer if You Reject the First One?

You absolutely can get another personal injury settlement offer if you reject the first one, but it depends on the strength of your case.

If you’ve rejected an offer from the insurance company and they are willing to negotiate further, they will probably come back with another number that is closer to what you were hoping for. However, companies may not always be willing to change their initial offer. If this happens, you can still work toward getting as much money as possible out of them in court through litigation.

What to Do After You Reject a Settlement Offer

If you think the insurance company might change its mind and offer more than the amount they submitted before, it’s worth waiting to see if they do so. Otherwise, bring in a lawyer and go back into negotiations with them to see if they can come up with a better deal or convince them to accept one of your ideas.

If that doesn’t work out either, then it’s probably time for another legal move: suing them. Here are some things to keep in mind if you choose this route:

Document All Communication

The more documentation you have of the communication between you and the insurance company, the better. If they offer a settlement amount and then change their mind, for example, you’ll want to have records of why. This should be enough evidence to help your case or at least raise questions about how accurately they investigated your claim.

Remember to respond to the insurance company politely. This will help when it comes time for court proceedings because it shows that you were acting in good faith and genuinely trying to reach a solution.

Confirm That You Followed the Correct Reporting Procedure

Filing a claim with an insurance company is always tricky—you need to understand the exact reporting procedure or you risk a lowball settlement offer. But following the rules can do more for your claim than you think.

You can also use it as evidence that you did everything by the book. The insurance company may not offer what you deserve, but you can show that you took all possible steps to receive the right compensation for yourself and your family.

Find an Experienced Attorney

You can represent yourself in court, but personal injury cases can be difficult to navigate on your own. With the right attorney by your side, all the legal details are taken care of for you.

They’ll provide you with the best possible chance of winning your case. During your suit, they’ll make sure that all the evidence is in place, that the right people are called to testify, and that you get fair payment for your injuries.

However, not all attorneys are equal, so find a firm with several years of experience and personable lawyers who will take the time to help you through every step.

Get the Settlement You Deserve With Our Help

If the insurance company is offering you a smaller settlement offer than you deserve, don’t agree to it. A personal injury lawyer can help you get the settlement that fits your case and your injuries.

Call an attorney from RHINO Lawyers to learn more about what they can do for your case and how they will fight for your rights. Our goal is to get you fair and just compensation for what happened. We will ensure that no one takes advantage of your situation.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

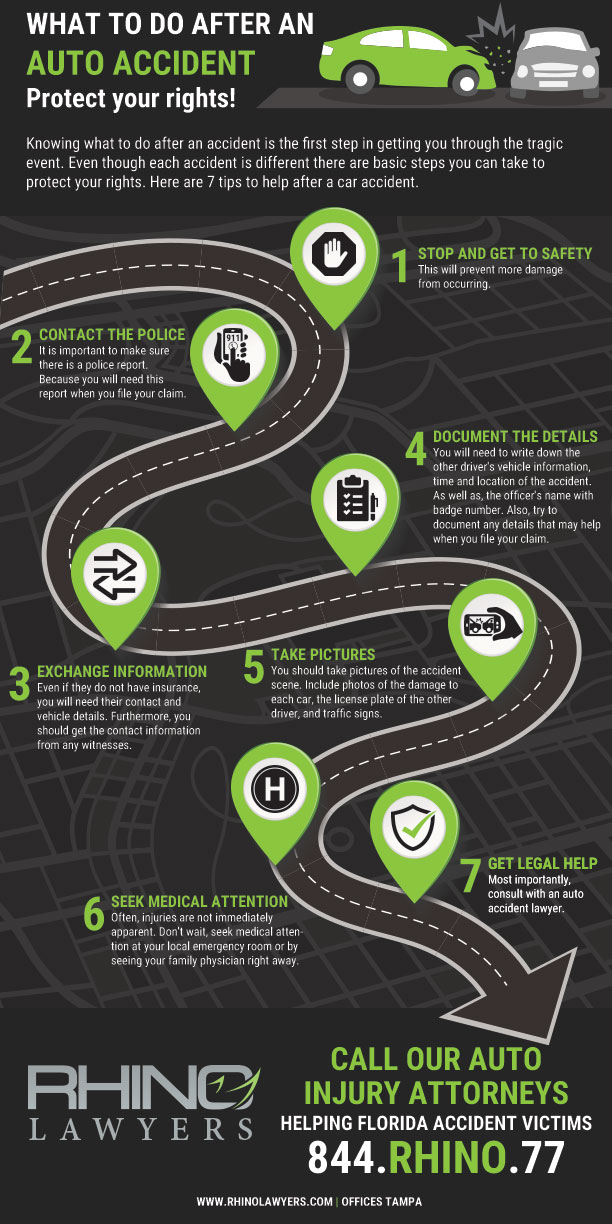

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.