First of all, the legal system has many obscure terms. But most people don’t hear these terms unless they study law. Or, they find themselves in a legal situation that requires them to know the term. Unfortunately, one of these terms is Subrogation.

In fact, if you file a personal injury claim you might hear this term. Either, while dealing with the other driver’s insurance company or yours. In either case, here is what you should know about subrogation and your personal injury settlement.

Defining Subrogation

Specifically, Merriam-Webster says subrogation is “the assumption by a third party (such as a second creditor or an insurance company) of another’s legal right to collect a debt or damages.” In other words, it is when insurance attempts to collect reimbursement from the at-fault party or insurance company. But only if they paid benefits to the injured person during an injury claim.

Understanding Subrogation

First, the subrogation process is somewhat confusing. Yet, it is a fundamental component of a personal injury claim. Moreover, insurance companies in Florida have the right to subrogate the at-fault driver’s insurance and the driver. So, the insurance carrier or the UM insurer can recover the money they paid because of the at-fault driver.

For example, say the other driver does not have enough coverage to pay damages. Then, you can use your uninsured/underinsured (UM/UIM) coverage to cover some of the expenses. Eventually, your claim settles with the other driver. Given that, the case settled the UM/UIM insurer can now pursue subrogation.

More importantly, Florida law states the UM/UIM insurer can’t recover more than they paid to you. As well as, it doesn’t allow you to “double-dip” or receive damages twice from the at-fault party. Yet, it does allow you to recover any deductibles you paid to your insurers.

Who Has Rights To Subrogation?

Incidentally, your insurance company and UM/UIM insurer are not the only parties allowed to pursue subrogation. In fact, subrogation allows other entities a legal claim against settlement money from the at-fault party. For example, these entities include:

- Medicaid

- Medicare

- Health Insurance Companies

- Workers’ compensation

- Veterans Administration

Additionally, most state assistance programs can legally pursue reimbursement with a subrogation claim. Because all the different parties allowed subrogation these claims can become complicated quickly. So, if suffered injuries in a car crash talk to a Tampa auto accident attorney.

UM Insurer Waiver

Actually, your insurance or UM/UIM insurer can choose to waive their right to subrogation. As a matter of fact, the at-fault driver usually requests the waiver when they want a quick settlement. Yet, it is important to note the insurance company has 30 days to waive its right to subrogation or keep it. So, if they waive their right you can finalize your settlement. But if they don’t waive their right you could recover your deductible.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

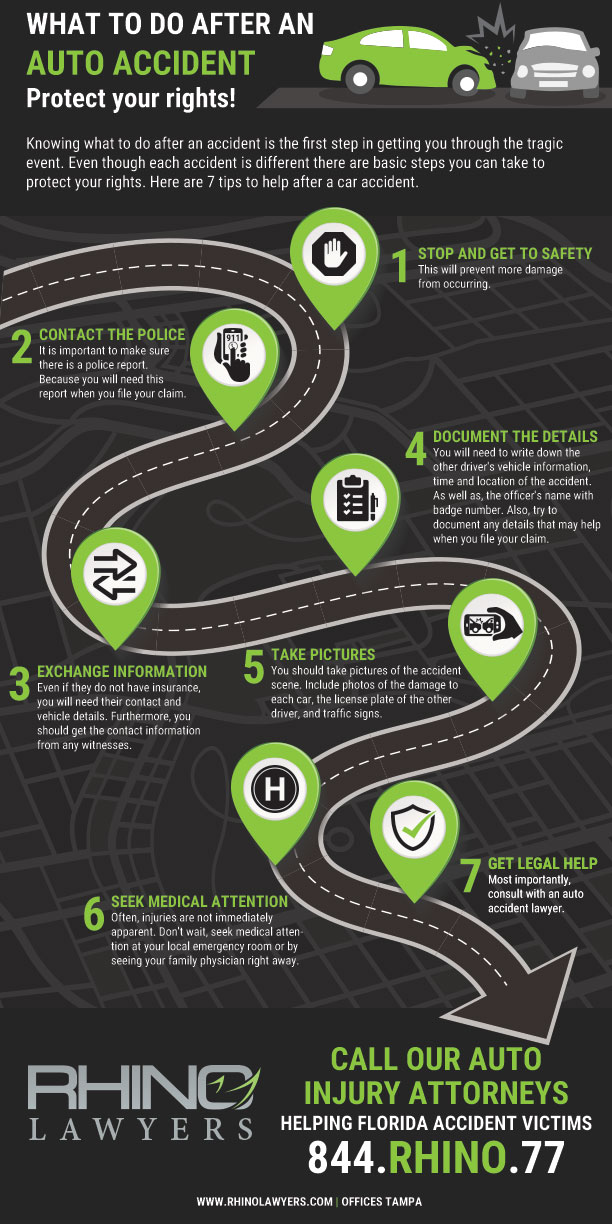

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.329.3491.