Clio reports that personal injury settlements often range from $10,000 to $75,000. However, the exact figure can vary significantly due to a variety of factors.

So, when handling a personal injury case in Florida, this average can help you understand what to expect. You may also wonder, ‘Are personal injury settlements taxable?’ Knowing the answer can help you plan for taxes during settlement negotiations.

It lets you protect more of your compensation and avoid unexpected tax issues later. Understanding what portion may be taxed provides you with a clearer financial picture and enables you to make better choices.

Read on to discover whether personal injury settlements are taxable in Florida and how to prepare for what comes next.

Understanding the Basics of Personal Injury Settlements

A personal injury settlement is the money paid to someone harmed by another party’s careless or intentional actions. The compensation can cover:

- Medical expenses

- Lost wages

- Pain and suffering

- Emotional distress

- Punitive damages

- Loss of future earning ability

- Ongoing therapy or rehabilitation

How you handle each of these items can determine how much you will receive as a final settlement. Unfortunately, many people make the mistake of focusing only on economic damages.

They often think compensation only covers medical bills and lost income. That mindset can limit the value of your case.

To learn more about damages and get a proper estimate of your claim’s value, consult skilled attorneys like RHINO Lawyers. We have a team of competent legal professionals who can help you maximize your settlement.

In Florida, settlements may come from:

- Car accidents

- Slip and falls

- Dog bites

- Workplace incidents

- Other injury claims

Each case involves different factors, including fault, insurance coverage, and injuries suffered. Understanding the full range of legal compensation in Florida ensures you receive what you rightfully deserve.

Breaking Down Taxable and Non-Taxable Components

The Internal Revenue Service (IRS) has clear rules on injury settlement taxation. According to federal guidelines, compensation for physical injuries or physical sickness is generally not taxable.

Settlement money used for physical injury-related expenses is usually not taxed. These expenses may include:

- Hospital bills

- Surgeries

- Prescription medication

- Doctor visits

- Rehabilitation or physical therapy

Other components of the settlement often have varying taxation requirements. Understanding how each part is treated helps you keep more of your compensation and avoid IRS issues.

You will also negotiate smarter and avoid future surprises when filing your taxes. Having clarity on tax implications helps protect the value of your personal injury settlement.

Lost Wages

Compensation for lost wages counts as taxable compensation since it replaces the income you would have earned. The IRS treats this portion as regular income, similar to your pay.

Reporting it as earned income keeps your tax filing accurate and avoids legal issues. Planning with this in mind helps you manage your finances and prevents surprises during tax season.

Pain and Suffering

Pain and suffering related to a physical injury are generally not considered taxable under federal tax rules. Common examples include:

- Broken bones

- Severe burns

- Nerve damage

- Long-term physical pain

Compensation for these conditions is considered part of your physical recovery. Keeping detailed medical records that link the pain to a bodily injury helps protect this part of your personal injury settlement from being taxed by the IRS.

Emotional Distress

Emotional distress not linked to a physical injury counts as taxable income under federal tax rules. Common examples include:

- Workplace harassment

- Discrimination

- Defamation

- Wrongful termination

- Invasion of privacy

Keeping your settlement terms clear and separating non-physical claims from injury-related ones helps prevent confusion and unexpected taxes. Properly labeling each category during negotiations safeguards the rest of your compensation from misclassification by the IRS.

Punitive Damages

Punitive damages are always taxable, no matter what kind of injury or case you have. These payments aim to punish the at-fault person or company, not to assist you in recovery.

Courts award punitive damages in rare instances in which the wrongdoer acted with extreme carelessness or intent to harm. If your case settles outside of court, you are unlikely to receive punitive damages since most settlements do not include them.

The full amount is counted as income and needs to be reported when you file taxes. Because punitive awards can be large, it is smart to plan so you’re ready for higher injury settlement taxes.

Interest on the Settlement

Interest earned on delayed settlement payments is always taxable, even if the main settlement is not. Courts may add interest when the other party takes too long to pay the agreed amount.

The extra amount is not part of your injury compensation; it is classified as income. The IRS requires you to report it when filing your taxes.

Florida Tax Rules and What They Mean for You

One major benefit of living in the Sunshine State is that Florida tax rules favor injury victims. Florida does not charge state income tax, so you don’t need to pay state taxes on your personal injury settlement.

This rule holds even if some parts of your settlement are taxable under federal law, but you still need to follow federal tax rules.

The IRS expects you to report all taxable parts of your settlement. Ignoring this step could lead to penalties or added costs later.

Keeping a copy of your full settlement agreement helps make the process easier. It’s also smart to talk to a tax professional if you feel unsure. A quick consultation with a tax expert can help you accurately report amounts and avoid mistakes when filing your return.

Are Personal Injury Settlements Taxable? Consult an Attorney to Know

Are personal injury settlements taxable in Florida?

You won’t owe state income tax on your settlement. However, certain parts, such as lost wages or interest, may still be taxed by the IRS.

Understanding how Florida’s tax laws align with federal regulations helps you safeguard your compensation and avoid surprises.

At RHINO Lawyers, we handle every case with focus and care. Our team uses fast, modern tools to get results. Brandon F. Jones, our personal injury attorney and sole shareholder, brings more than 14 years of Florida accident experience.

Reach out today for clear answers, strong support, and the confidence to move forward.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

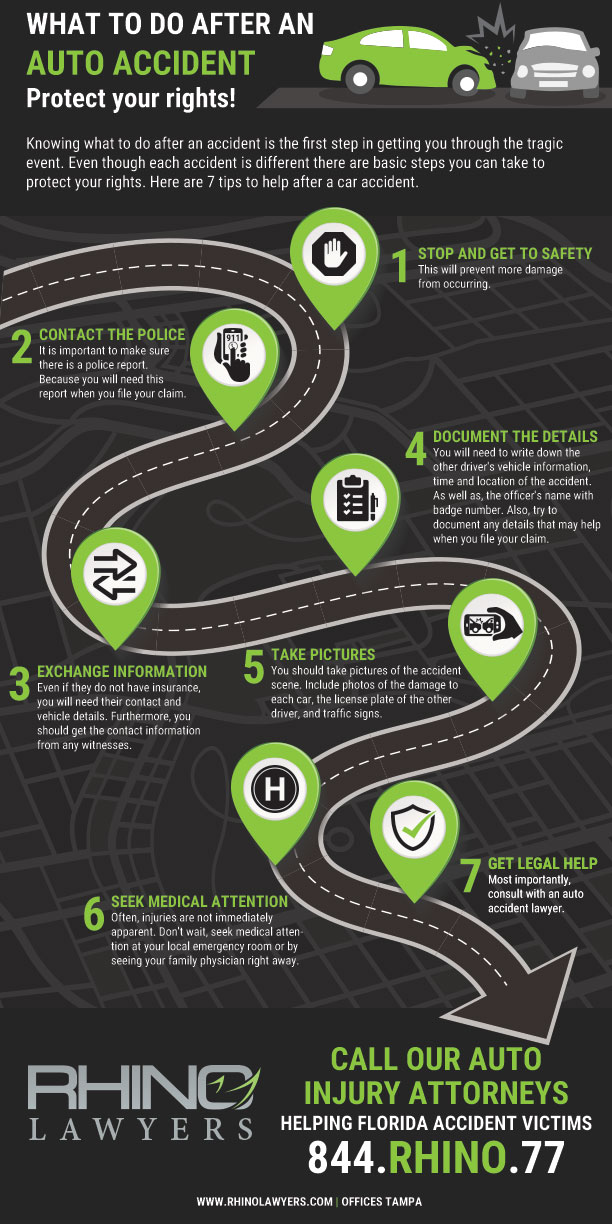

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.