In 2019, Florida experienced over 400,000 car crashes with people getting injured in over half of those accidents. No matter how safe a driver you are, there’s a good chance you’ll find yourself in a difficult road situation.

No one wants to wind up in the middle of an automobile accident, but what brings even more headaches is filing a car insurance claim.

Determining the cost of the damages to both you and your car is a time-consuming process. Plus, the road to recovery becomes even longer if you haven’t equipped yourself with the proper insurance coverage.

With all these factors that you have to juggle, how do you even set aside time to take care of current expenses? Thankfully, you don’t have to go through this alone.

If you’re ready to empower yourself with knowledge of what to do post-accident, read on to see how you can handle a car accident claim with confidence.

1. Choose Coverage for Any Car Insurance Claim

What kind of insurance plan you have will determine how high your costs are after an accident. Luckily, the types of car insurance Florida offers should cover the basics and then some. So before you hit the road, make sure you have a safety net in place.

Bodily injury liability, property damage liability, and personal injury protection (PIP) are must-haves. These coverages pay for injuries suffered by another driver and their car, as well as additional medical expenses.

Of course, you want to protect your own vehicle as well, so collision coverage is another must-have for your car insurance.

But what if you find yourself in a more unusual situation that doesn’t fall under typical coverage? You may want to pad your plan to prepare for unexpected happenings.

Uninsured Drivers

Florida has had high numbers of uninsured motorists over the years, so uninsured accidents are not as rare as one might hope.

If you get into an accident with an uninsured or underinsured driver, it doesn’t matter whose fault it is. You’ll be paying a hefty amount to bail out both yourself and the other driver.

Although you’ll pay extra for your insurance plan, uninsured and underinsured motorist coverage can save you a lot more down the road. So do the smart thing and factor uninsured drivers into your plan.

Extreme Events

There are plenty of other driving dangers you need to be aware of besides uninsured drivers. If your car is damaged by a natural disaster or vandal, you want to have purchased the proper insurance coverage.

Comprehensive coverage protects against a range of unusual circumstances, but it’s okay to be extra cautious. For example, you’ll be thanking yourself if you have to file a stolen car insurance claim one day.

Besides, you don’t want to take any chances when it comes to car accident costs. So make sure you know the types of coverage you need to feel safe on the road. Otherwise, filing a claim will become an expensive endeavor.

2. Calculate Your Car’s Value

When it comes to reporting a car accident insurance claim, determining the cost of the damage to your car can be a tricky process.

Start with the details of your car. You’ll want to note the year, make, model, mileage, and wear and tear. Your insurance company will use these factors, so it only pays for damage caused by the accident.

While taking your car in for repairs, you’ll also need to provide your insurance with at least one estimate from a mechanic. Sometimes your insurance company will ask for multiple estimates and argue for the lowest one.

Remember, your insurance company is a business that wants to save as much as possible. Don’t be surprised if they pull out tactics to avoid paying for costly repairs.

The COVID-19 pandemic has affected all businesses, and insurance companies are no exception. Be prepared to fight for compensation during these difficult times.

3. Determine the Full Extent of the Damage

The hardest part of the car insurance claim process is calculating the injuries you sustain. Not only do you suffer from the immediate impact, but health issues could come up later on.

Again, your insurance company is not your friend in this case. They will do everything they can to deny injuries and payments for your medical expenses.

When you contact your insurance after an accident, you’ll need to navigate the conversation with great expertise. On top of dealing with post-accident costs, this can be too much to handle.

So select a team of dependable car accident attorneys to represent you. They can win you proper compensation by helping you figure out your medical expenses beyond the scene of the accident.

Immediate Injuries

The first thing you should do is file a police report to document the events of the accident. Once you have the accident recorded, address your injuries immediately.

Don’t waste any time seeking medical treatment after an automobile accident. Your insurance company will want to see proof of your injuries, so you need hospital bills to back up your claim. Waiting will only make your claim look suspicious.

No matter what, don’t let your insurance company convince you you are fine. Remain consistent in your narrative, and stand by any injuries you feel you’ve received. Laying the groundwork now will help build the case for long-term injuries later on.

Long-Term Costs

It’s difficult to tell how accident injuries could linger, so don’t rush the process. You may have to pay consistent medical costs for months, so you want full compensation.

Time spent in the hospital translates into money lost from not working. And if your injuries stay with you, you might have to make adjustments at home to accommodate physical difficulties.

All these things can be covered in a car accident insurance claim settlement, so don’t sell yourself short.

Seek help from your attorney, and let them lead the way. They can help you calculate the long-term costs of your injuries and win you the amount you deserve.

Protect Yourself by Staying Informed

The best defense against a car accident and its repercussions is a well-informed driver. As long as you have a plan in place for what to do after an accident, you’ll be primed to file a car insurance claim and earn just compensation.

Everyone is under stress these days during the pandemic, including insurance companies. If you find yourself in a messy situation, you’ll need a trusted attorney who has your back.

Are you ready to protect yourself and your property? Contact us for a free consultation, so you can breathe easier knowing your ride is secure.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

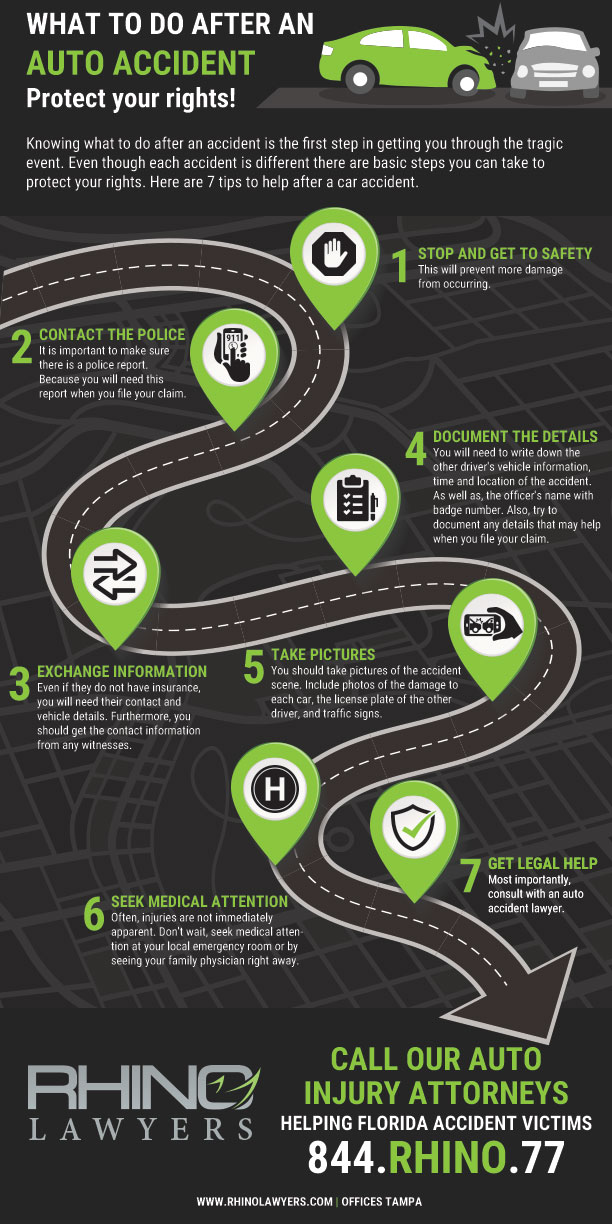

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.