The National Security Council reports that 5.1 million people sustained medically consulted injuries due to motor vehicle accidents in 2023. Many of these injuries force victims to miss work, sometimes for long periods.

When your income stops but your expenses keep coming, the financial pressure can be intense. Medical bills, rent, and daily costs do not wait for you to recover.

Proving lost wages is essential for easing this burden. Strong evidence of your missed income can make the difference between fair compensation and a denied claim.

Insurance companies will not pay unless you can clearly show what you lost. Learn how to prove lost wages after a car accident so you can secure fair compensation, protect your finances, and focus on your recovery.

Understanding Lost Wages in Car Accident Claims

Lost wages refer to the income you miss when an injury keeps you from working. They can include:

- Your regular pay

- The overtime you were scheduled to work

- Bonuses you would have earned

- Commissions from sales or other work activities

These losses can quickly disrupt your financial stability, especially when recovery takes time. Lost wages differ from other damages in your claim.

Medical expenses cover only the cost of treatment and care. Pain and suffering compensate for the emotional and physical distress caused by the accident.

Lost wages focus entirely on the income you could not earn while you were unable to work.

In some cases, injuries may affect your ability to work in the future. This is known as future lost income. Proving financial losses is essential to ensure you receive full car accident compensation.

Why Proving Lost Wages Matters

Proving lost wages directly affects your car accident compensation. Lost income can make up a large part of what you are owed.

Without adequate proof, you risk receiving less compensation than you deserve. Insurance companies:

- Need solid evidence before they pay for lost wages

- Check if your injuries truly kept you from working

- Deny or reduce claims when proof is missing or unclear

Strong evidence makes your claim harder to dispute. The clearer your proof, the better your chance of getting full payment.

Key Documents Needed to Prove Lost Wages

Strong documentation is vital to support your lost income claims process. The right evidence shows exactly how much you lost and why you deserve full car accident compensation.

Here are the key wage verification documents you need to collect:

Employer Verification Letter

Your employer should provide a letter confirming the details of your job. The letter needs to include:

- Dates you missed work

- Your salary information

- Your job title

- The hours you typically work

This letter directly links your missed work to the accident. It also gives insurers clear proof that your injury resulted in a measurable loss of income.

Pay Stubs and Tax Returns

These documents verify your income history. They show what you normally earn and help calculate the exact amount of your lost wages.

Medical Records

Medical records link your injury to your inability to work. They confirm that your time away from work was necessary because of the accident.

Additional Evidence

Other documents can strengthen your case, such as timesheets, bank statements, and correspondence with your employer. These provide extra support if the insurer questions your claim.

Steps to Prove Lost Wages After a Car Accident

Proving lost wages takes more than just saying you missed work. You need to follow the right steps and collect strong evidence.

Here is what you should do to strengthen your lost income claims process:

Step 1: Seek Medical Treatment Immediately

Seek medical care immediately following the accident. It helps create a record that connects your injuries to your absence from work.

Without this link, insurers may question your claim.

Step 2: Notify Your Employer

Notify your employer about your injuries and inform them of your need to take time off. Keep copies of all emails or letters and ask for official documentation of your absence.

Step 3: Gather Wage Verification Documents

Collect all wage verification documents such as pay stubs, tax returns, and the employer verification letter. These documents help to prove the amount of income you lost during your recovery.

Step 4: Work with a Personal Injury Attorney

Having a lawyer on your side strengthens your claim. At RHINO Lawyers, we can help you prove your financial losses with solid evidence. We know how to challenge insurance companies and protect your rights.

Our support makes it harder for insurers to deny or reduce your payout. You can concentrate on healing while we secure your deserved compensation.

Step 5: Present Your Claim Effectively

Once you have gathered all the necessary evidence, focus on how you present it. Organize your documents clearly and follow the insurer’s submission guidelines.

A well-prepared claim shows you are serious and leaves little room for disputes. This increases your chances of a smooth approval and fair payment.

Special Considerations for Self-Employed Individuals

Proving lost wages is often harder for self-employed accident victims. Unlike salaried workers, you may not have employer letters or regular pay stubs to show your income.

Insurers may question your earnings or claim they are inconsistent. You can strengthen your lost income claims process by providing detailed records such as:

- Invoices for completed work

- Signed contracts with clients

- Client correspondence confirming canceled or delayed projects

- Profit and loss statements showing your typical earnings

Maintaining accurate records is essential. Well-organized documents make it easier to prove your losses and reduce the likelihood of disputes.

If you need help, RHINO Lawyers can guide you through the process.

Protect Your Finances: Claim the Lost Wages You Deserve Today

Protecting your finances starts with taking the right steps to prove your lost wages. With strong evidence and the right support, you can secure the compensation you deserve and avoid financial setbacks.

At RHINO Lawyers, we fight for clients seeking compensation for lost wages, auto accident injuries, medical malpractice claims, and criminal defense. Since 2014, our Millennial-led team has combined insider insurance experience with modern, client-friendly communication to achieve outstanding results.

We break away from outdated legal practices by offering fast responses, human-to-human support, and strategies that consistently deliver stronger settlements. Get in touch for a legal experience that puts you first.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

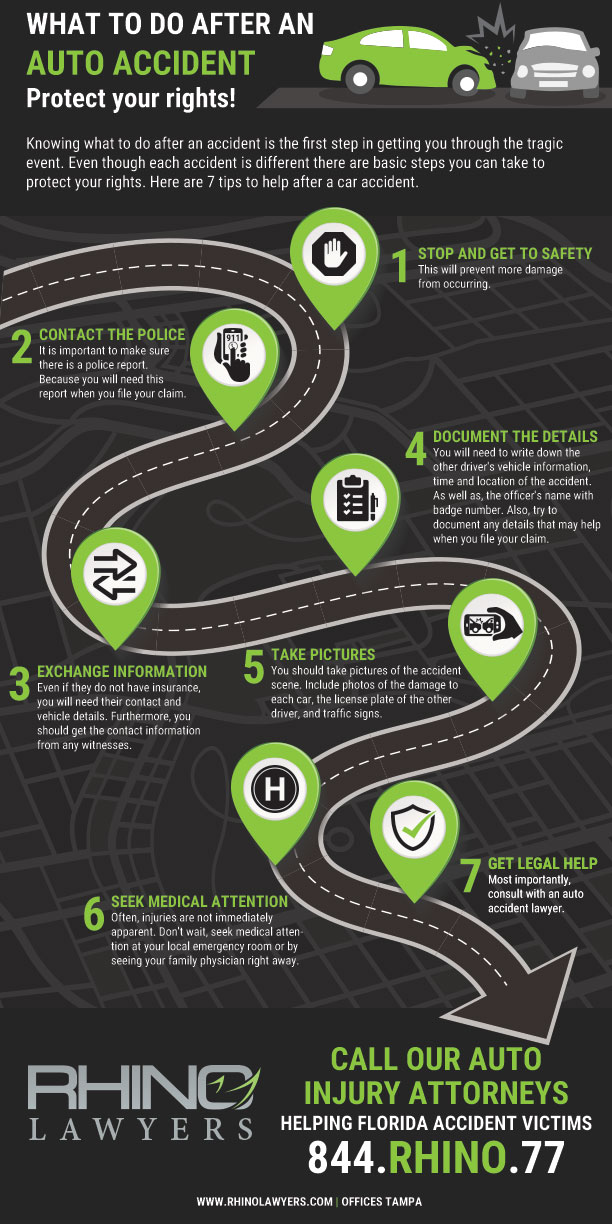

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.