The Role of Whistleblowers in Combating Tax Fraud

Whistleblowers play a critical role in uncovering tax fraud. Complex financial structures often conceal fraudulent practices, making it difficult for tax authorities to detect them without insider information. By stepping forward, whistleblowers provide crucial evidence that can lead to investigations, prosecutions, and the recovery of lost revenue.

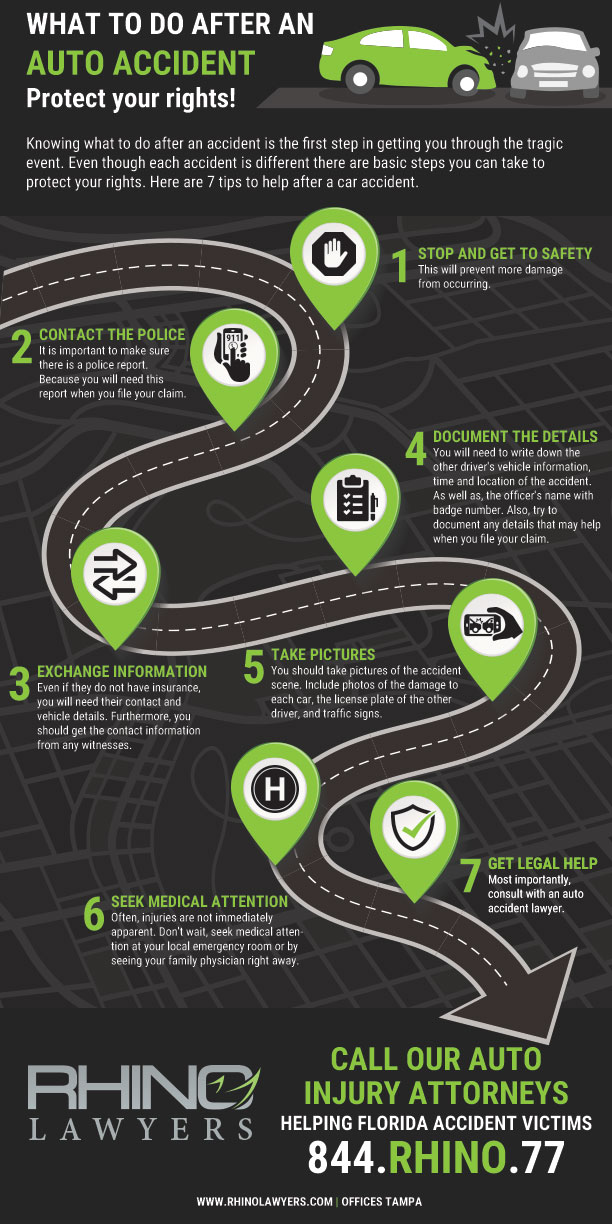

At RHINO Lawyers, we recognize the courage it takes to expose fraud and are committed to protecting whistleblowers from retaliation while ensuring their efforts are rewarded.

Protections for Tax Fraud Whistleblowers

The IRS Whistleblower Program provides strong protections and incentives for individuals who report tax fraud. Key aspects of the program include:

- Confidentiality: Whistleblower identities are kept confidential to the fullest extent possible.

- Anti-Retaliation Protections: Federal laws protect whistleblowers from employer retaliation, such as termination, demotion, or harassment.

- Financial Rewards: Whistleblowers may receive a percentage of the recovered taxes, penalties, and interest if their information leads to successful enforcement actions.

Our attorneys have extensive experience navigating the IRS Whistleblower Program and will work diligently to maximize your protections and potential rewards.

Eligibility for the IRS Whistleblower Program

To qualify for the IRS Whistleblower Program, the following criteria must be met:

- The alleged tax fraud must involve significant underpayment of taxes (generally exceeding $2 million, including penalties and interest).

- For cases involving individuals, their annual gross income must exceed $200,000.

- The whistleblower must provide specific and credible information that can lead to successful enforcement actions.

At RHINO Lawyers, we’ll help you determine if your case meets these criteria and guide you through the reporting process.

How RHINO Lawyers Can Help You

Filing a whistleblower claim for tax fraud is a complex process that requires thorough preparation and legal expertise. RHINO Lawyers provides comprehensive support to ensure your case is handled effectively.

Our Services Include:

- Case Assessment: We’ll evaluate the details of your claim to determine its strength and eligibility under the IRS Whistleblower Program.

- Evidence Compilation: Our team will help you gather and organize the necessary documentation to support your allegations.

- Filing Your Claim: We’ll prepare and submit Form 211, the official claim form for the IRS Whistleblower Program, ensuring all required information is included.

- Legal Representation: If your claim progresses to an investigation or litigation, we’ll provide skilled representation to protect your interests.

- Reward Maximization: Our attorneys will advocate for the highest possible financial reward for your contributions.

With RHINO Lawyers by your side, you can feel confident in your decision to expose tax fraud and seek justice.

Common Challenges Faced by Whistleblowers

While whistleblowers play a vital role in uncovering tax fraud, they often face significant challenges, including:

- Employer Retaliation: Fear of losing your job or facing workplace harassment can deter whistleblowers from coming forward.

- Legal Risks: Reporting fraud may involve navigating complex legal issues and potential counterclaims.

- Emotional Toll: The process of exposing fraud can be stressful and emotionally taxing.

Our team understands these challenges and is committed to supporting you through every stage of your case. From providing legal protections to addressing emotional concerns, we’ll ensure you’re equipped to move forward confidently.

The Benefits of Taking Action

Exposing tax fraud not only helps recover lost revenue but also promotes transparency, accountability, and fairness in our financial systems. By taking action, you:

- Protect Public Interests: Ensure taxpayer dollars are used to fund essential services.

- Hold Wrongdoers Accountable: Deter future fraud by exposing illegal practices.

- Receive Financial Rewards: Whistleblowers may be entitled to substantial monetary awards for their efforts.

- Foster Integrity: Contribute to a culture of honesty and fairness in business and finance.

At RHINO Lawyers, we’re passionate about empowering individuals to make a difference and fight against systemic fraud.

The Process of Filing a Tax Fraud Whistleblower Claim

If you suspect tax fraud and wish to file a claim, the process typically involves:

- Initial Consultation: Meet with our experienced attorneys to discuss your case and determine its viability.

- Evidence Gathering: Work with our team to compile detailed and credible evidence supporting your allegations.

- Claim Submission: File Form 211 with the IRS Whistleblower Office, outlining the fraud and its financial impact.

- IRS Evaluation: The IRS will review your claim and, if deemed credible, initiate an investigation.

- Enforcement Actions: If the investigation confirms fraud, the IRS will pursue enforcement and recover funds.

- Reward Distribution: Once the case is resolved, eligible whistleblowers will receive their reward, typically ranging from 15% to 30% of the recovered amount.

RHINO Lawyers guides you through each step, handling your case with precision and care.

Why Choose RHINO Lawyers?

When you choose RHINO Lawyers, you gain a trusted partner dedicated to your success. Here’s why clients turn to us:

- Extensive Experience: Our team has a proven track record of handling whistleblower cases, including complex tax fraud claims.

- Client-Centered Approach: We prioritize your needs and tailor our strategies to achieve the best possible outcome.

- Fierce Advocacy: We’re relentless in pursuing justice and ensuring whistleblowers receive the recognition and rewards they deserve.

- Confidentiality and Protection: Your privacy and safety are our top priorities.

With RHINO Lawyers, you’re not just a client—you’re a valued partner in the fight against fraud.

Take Action Today

If you’ve witnessed tax fraud, don’t wait to take action. By coming forward, you can make a significant impact, protect public resources, and secure a brighter future for all.

Contact RHINO Lawyers today for a confidential consultation. Let us help you navigate the complexities of the IRS Whistleblower Program and ensure your efforts are rewarded. Get YOUR Free Case Analysis now by texting us, chatting with us online, completing the form below, or by calling 844.RHINO.77.