Rental car insurance can be complicated, and you may end up not being covered if you don’t know what to expect. A provider may deny coverage for certain types of damage, or if you break any rules of the agreement, such as letting someone else drive the vehicle.

According to an article from Consumer Affairs, there are more than 3,000 rental car companies in the US, and in 2023, about 48 million Americans used a car rental service.

Renting a car gives you freedom and flexibility, but when the unexpected happens, your peace of mind depends on understanding how rental car coverage works. Many drivers assume that once they’ve paid for their insurance protection upfront, they’re fully covered in any situation, but this isn’t always the case.

This article explores how rental car insurance can fail after a crash and how to protect yourself when the unexpected happens.

Should I Take Out Extra Insurance When Renting a Car?

It can be tempting to skip the extra protection offered at the rental counter, especially if it feels expensive. This extra coverage is often sold as:

- Collision damage waiver

- Loss damage waiver

- Supplemental liability insurance

It can sometimes make the difference between paying out-of-pocket and being mostly covered. Here’s where the pitfalls begin:

Waivers Don’t Always Cover Everything

Many waivers exclude certain kinds of damage, such as:

- Glass

- Undercarriage

- Tire damage

- Interior damage

- Wear and tear

- Theft if you left the car unlocked

Some only cover you up to a set monetary limit, leaving you responsible for the remainder.

“Zero-Excess” or “Full Protection” Claims May Be Denied

The rental company or its insurers may deny certain parts of a claim. They may cite things like driver error or breach of contract, for example.

Unauthorized Drivers

Only authorized drivers should operate a rental vehicle. If someone else drives a rental car (i.e., someone who isn’t listed on the contract), insurers may refuse to cover the accident.

Violation of the Rental Agreement

Keep track of where you’re permitted to drive the rental vehicle. If you drive off-road, outside geographic limits, bajo la influencia, or engage in prohibited activities, the coverage can be voided entirely.

Deductibles, Hold Charges, and Administrative Fees

Even if coverage applies, you may still face additional charges. This can include deductibles, hold deposits (which are later released but tie up funds), or service fees from the rental company.

Does My Credit Card Offer Rental Car Insurance?

It might, but relying solely on credit card rental car coverage is risky. Many premium credit cards offer rental car insurance as a cardholder benefit, but it often comes with restrictions, limitations, and fine print.

Here are some key caveats and pitfalls to watch out for:

Secondary vs. Primary Coverage

Most credit cards offer secondary coverage, meaning they only kick in after your personal insurance pays. If your personal policy denies coverage, your credit card provider may pay nothing.

Type and Duration of Coverage

Many credit cards only cover collision damage and theft, not liability or medical costs. Some impose a maximum number of days or geographical restrictions (e.g., excluding certain countries).

Qualifying Conditions

You often must decline the rental company’s collision damage waiver (CDW/LDW) to activate the card’s coverage. Failing to pay for the rental with your credit card can also void the benefit.

Excluded Vehicle Classes

Some cars may be excluded from certain credit card policies. These often include:

- Luxury cars

- Vans

- Camiones

- Specialty vehicles

Administrative Claims Hurdles

Even when coverage is available, the card issuer requires prompt notification, documentation (such as a police report or repair invoices), and adherence to strict timelines. If you miss a deadline or fail to provide required documents, your claim may be denied outright.

How Rental Car Coverage Fails in Post-Accident Scenarios

After an accident, various things can go wrong. Even when you think you have solid protection, you may still face these issues:

Delayed or Denied Claims

Insurance adjusters may seek out loopholes. They might use these to minimize payments on rental car claims. Some typical examples include arguing that you drove recklessly or outside of permitted zones.

Coverage Gaps

Even if your agreement promises full protection, there may be a monetary ceiling or limits on repair costs. You may end up responsible for excess beyond that cap.

Liability Gaps

Your rental agreement’s coverage often focuses on damage to the rented vehicle itself. If you injure a third party or damage their property, you might need liability coverage from your personal auto policy or secondary carry-on policies.

Subrogation and Surprises

The rental company’s insurer may pay initially but then seek reimbursement from you (subrogation). They’re likely to try this if they believe your actions breached the agreement (e.g., using an excluded driver).

Loss of Personal Items

Many rental policies won’t cover personal belongings. If you lose or damage any personal items in the vehicle during the accident, you likely won’t be able to claim them.

Administrative or Hidden Fees

Even if coverage is accepted, you can face other fees. Consider:

- Loss of use charges

- Towing fees

- Storage costs

Preguntas frecuentes

What Kind of Damage Is Most Often Denied Under Standard Rental Car Coverage?

Denials often arise for damage to the glass, undercarriage, wheels/tires, or the interior unless you purchased a full protection waiver. Theft claims may be rejected if you left keys in the car or failed to lock the doors.

Can the Rental Company Charge Me for Loss of Use if My Coverage Applies?

Yes. Some contracts allow the rental company to charge you for the time the car was out of service during repairs. Some waivers mitigate this, but not always fully, and insurers may push back.

What Role Does Legal Representation Play in Rental Car Claims After an Accident?

A lawyer with experience in post-accident insurance disputes can provide valuable assistance in several ways. They might challenge unfair claim denials, fight hidden loopholes or subrogation attempts, negotiate with insurers, and protect your rights, especially when serious damage or liability is involved.

Protecting Yourself

Rental car insurance can fail you after an accident in more ways than most renters expect. If this happens, having solid legal representation can be invaluable.

RHINO Lawyers is here 24/7 to offer reliable legal assistance. We have hundreds of 5-star reviews and have recovered almost $100,000,000 for our clients. Contacte con nosotros hoy mismo!

CONTACTE A UN ABOGADO DE ACCIDENTES DE AUTO EN TAMPA

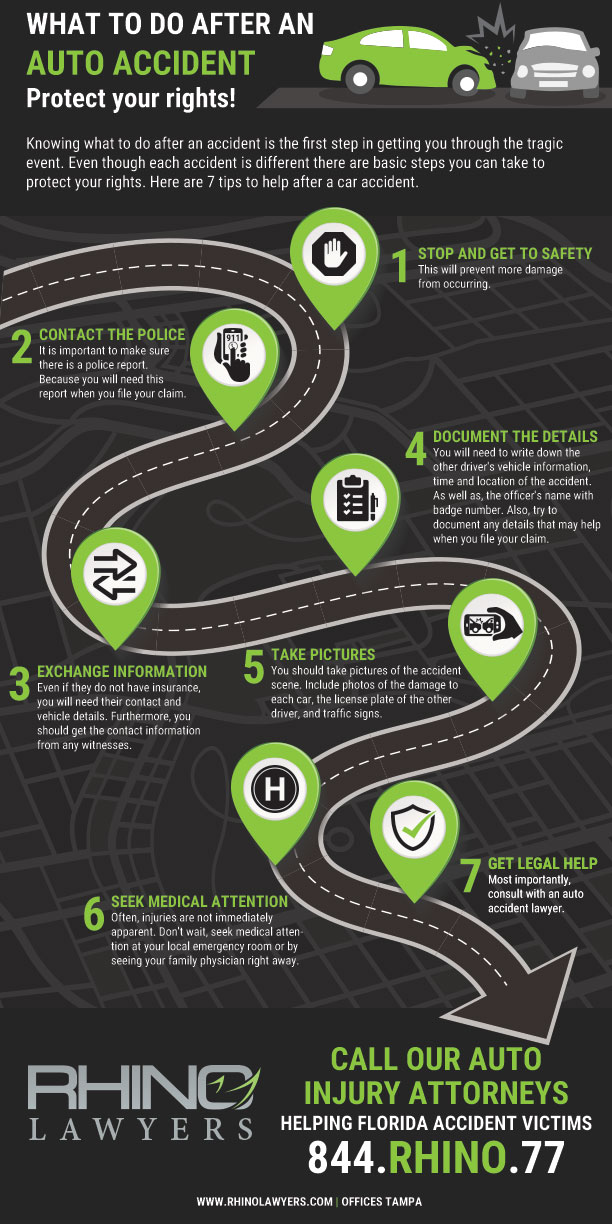

En resumen, después de un accidente de coche, es posible que no conozca sus derechos. Sobre todo, no luche solo en el proceso. En realidad, nuestro equipo de lesiones personales está aquí para ayudarle con cualquier necesidad legal que pueda tener en relación con su accidente.

Por último, dejemos que RHINO Lawyers responder a sus preguntas y revisar los hechos de su caso con una consulta gratuita. Así que, comience completando el "EVALUACIÓN DE CASO GRATUITA INSTANTÁNEAMENTE" o llamándonos a cualquier hora, de día o de noche, al 844.RHINO.77.